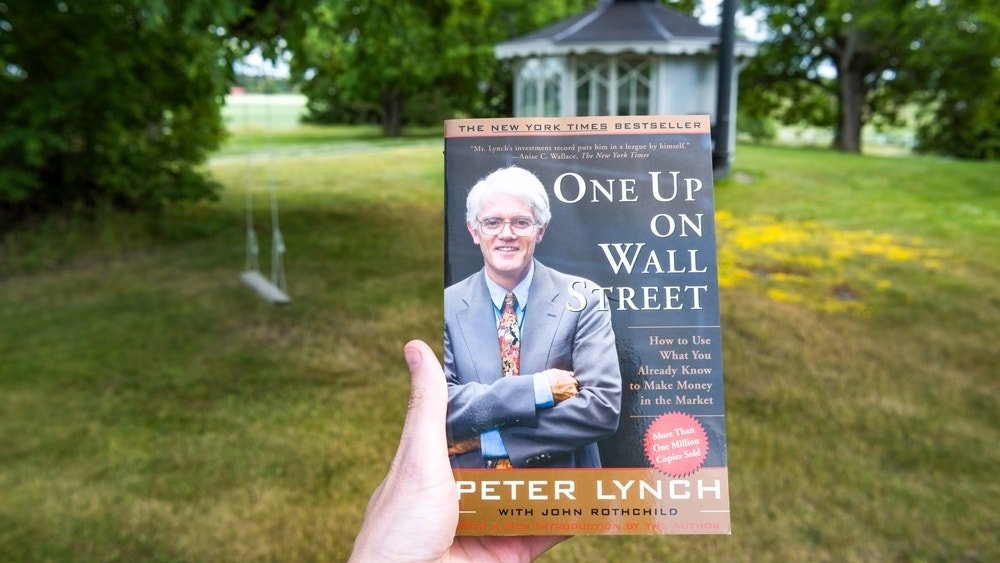

Failed owner Peter Lynch When the knowledge is confirmed to know the business after money before investing with himself, he also asked the effectiveness of economic forecast.

What happened: Ynch, it is known for his successful punishment in eternal money, which said his investment perspective in 1997 speech.

He established the importance of business after the tree, instruction, “what you can decide the purpose of the animal’s status. The story.”

This method means in the line Warren BuffettThe investment strategy is recommended for investment in parts of personal expertise.

Lynch dissolved the concept of economic predictions, and identifying himself “below” and business analysis and business analysis.

Also read: Investment Guru Peter Lynch: ‘In general investments are the place you think you’re crazy’

He also had the significance of the patient to invest, saying that the returns could be determined even after ten years after release the first tribe. He was mentioned KapAPPs For example, it is about investing a Marathon, not a bay.

“A decade after 1970, only 15% of them, but the success is not active to talk about Walmart.

What is the matter: Lynch methods provides a great way for new owners and traits of time. His importance to the business of the business is to focus on individual trees, and perform patients connected to successful money owners according to the Buffett.

His knowledge is the reminder of the investors that succeed in the money manufacture of decisions and playing a long time.

Reading Reading Ready